One of the most common and interesting ways to invest your money is to buy real estate. Even given all the ups and downs in the last ten years, real estate still proves to be an interesting and steady investment in the long run. If you are considering buying real estate and renting it out, please learn from our experiences and avoid making one of the ten big mistakes when investing in rental property.

One of the most common and interesting ways to invest your money is to buy real estate. Even given all the ups and downs in the last ten years, real estate still proves to be an interesting and steady investment in the long run. If you are considering buying real estate and renting it out, please learn from our experiences and avoid making one of the ten big mistakes when investing in rental property.

First, let’s explore our real estate portfolio and the reasons we are actively investing in rental property.

Our real estate portfolio

In the last few years, we have worked hard to build up a small but stable real estate portfolio. Between 2011 and 2016 we were able to invest our money in three properties in the city of Rotterdam in the Netherlands.

Two of those properties are rented out to students, which provide us with a passive income. If you are interested to learn how we were able to save enough money to pay for three houses in cash, please read this article.

Investing with the double win factor

The interesting part of investing in rental property is that it improves your financial situation in two different ways. Investing in rental property is a great way to use the double win factor. This means that the money you invest will work twice as hard for you.

Let me explain:

First, investing in real estate can be a smart way to grow your savings, as the housing market can go up. This may give an interesting value increase, but of course, this is not a guarantee. It is speculation and should be done wisely. Second, once you have invested in a property, you can rent it out to generate cash flow from your asset. This means you will generate a Return on Investment (ROI) on your investment.

So while your investment is growing in worth due to a rise in the housing market, you are also generating income from your tenants. That’s a double win!

Investing to create financial freedom

A growing number of young people are looking for new ways to create financial freedom. Only 48 percent of millennials (age 21-36) believe that buying a home is a good investment, according to the latest ValueInsured Modern Homebuyer Survey.

And while buying an expensive house to live in, may not be worth it. Investing in the right kind of real estate can be a very smart tactic that may actually help you create the financial freedom you are looking for. For instance to retire before you’re 40.

As an example: of the three properties we own, we live in the smallest and cheapest ourselves. The other two properties are rented out, which allows us to live for free in our own house. All expenses are paid from the rental income! And on top of that, we can save more than 2.000 Euros in rental income EACH MONTH.

Talking about financial freedom!

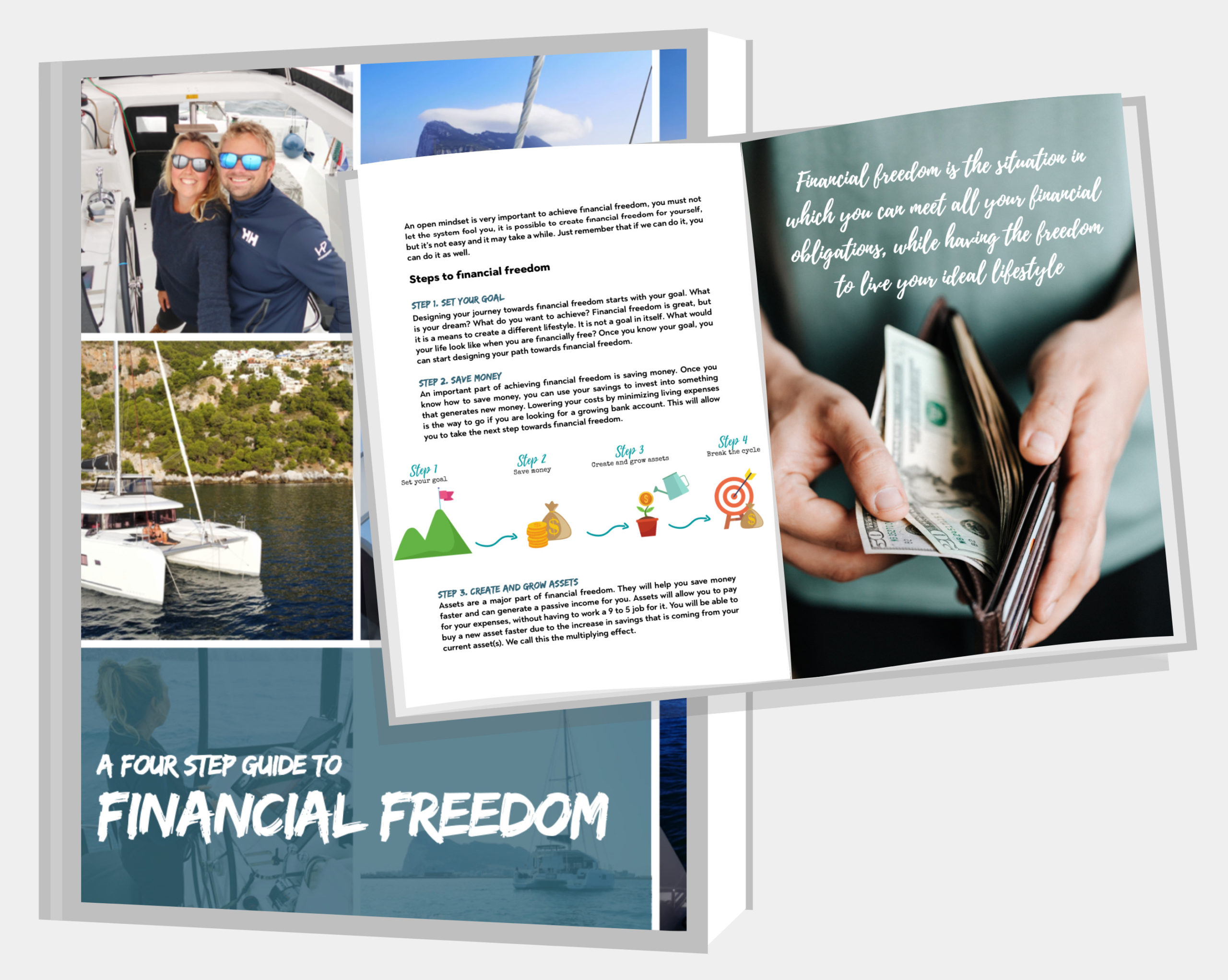

SUBSCRIBE & DOWNLOAD YOUR FREE GUIDE

We share our steps & tips about Financial Freedom in a cool and free PDF guide. Subscribe to our newsletter by leaving your email below and you can download the guide right away!

Avoid the big mistakes

So did we spark your enthusiasm? Are you looking for opportunities to invest in the rental property yourself? Or are you considering investing a few years from now? If you want to know how to invest in a rental property or how to start investing in real estate please make sure to avoid the mistakes that we often see others are making when investing in rental property.

We summed up ten things we would definitively advise you to NOT do when starting to invest in a rental property. Of course, this is our personal opinion, so view it critically and determine for yourself whether you can use them to your advantage.

The ten BIG MISTAKES:

1. Going into serious debt

If you are looking to invest in rental property, we would always advice you to do so with your own money if possible. A loan or mortgage has a few disadvantages. There are closing costs, monthly interest fees and the risk of foreclosure when you fail to pay. In addition, mortgage providers often do not allow renting out a property to secure their collateral.

Next to these practical issues, more importantly there is the independency factor. Being financial freedom enthusiast, we don’t like to be at the mercy of financial institutions. When investing for yourself and your future, it is always best to keep as much control over the situation as possible. Using your own money gives you more freedom and less dependency.

If you would decide to use a loan or a mortgage to invest, we personally would do it only temporary. For instance to be able to secure a great investing opportunity. This means we would aim to pay off the debt as soon as possible and choose a financial construction that allows this. We also would try to minimize the amount of the loan needed and cofinance it with our own money. That way – should the market drop – you still won’t have issues repaying the mortgage when forced to sell the property.

Again, this is a personal view. We know a lot of people invest with loans and it is up to you to make your own decision on what risks and structures fit your personal situation.

2. Investing in rental property in an unknown location

If you want to invest in rental property, you are better off keeping it local. Buying a property in your own city has many advantages.

When you buy in a know location, you know the quality of the neighborhoods, the plans for urban development, the ups and downs of the housing market and you know when an investment is a good deal.

Investing in a known location also makes maintaining the property easier. You probably are aware of the best places to find new tenants and practical issues (such as repairs) are arranged much easier because you have knowledge of businesses in the area that have a good reputation.

3. Buying a rental property that needs a lot of maintenance

This may sound like a no-brainer, but it is definitely a big mistake that is easily made. If you are planning to rent out the property, make sure you buy a low-maintenance house. This includes the exterior of the building as well as the interior.

Look for an idiot-proof house to make sure you don’t have tenants calling you constantly when things break and losing the great ROI you thought the property would yield.

If you are looking for low maintenance, look for smaller properties that are for instance part of a bigger building. Apartments can be great, as long as there are no high service fees.

4. Not calculating your ROI beforehand

You invest in rental property to make a nice return on investment. This means that when you are considering investing, you need to calculate your return on investment (or ROI) beforehand.

What are all the costs associated with the property each year and what are the yields? Be as precise as possible and don’t forget to think about costs such as liability insurance and extra maintenance (things will probably break more than in your own house).

Be realistic about the possible earnings: there are bandwidth and a maximum to what you can ask for rent in a certain location. Also, do not buy a super expensive property: it will kill your ROI instantly. We try to achieve an ROI of 10%. This means we will earn back the investment in 10 years.

5. Focusing solely on your ROI

Yes, your return on investment is important and you should make a detailed calculation for each property you are investigating. However, it is a risk to fixate on the ROI solely.

It is just as important to look at what you are left with as an income source below the line. Your ROI maybe 20%, but if it only gives you a net revenue of 500 Dollars per month, it may not be worth the risk and the hustle. Be critical about the cash flow coming out of your investment and make sure it is aligned with the reason for investing in the rental property in the first place.

The other BIG mistakes

So, there you have it: the first five BIG MISTAKES when investing in rental property. And no, you didn’t misinterpret the title 😉 there are ten BIG MISTAKES in total. Do you have an idea what they might be? Mistakes 6 through 10 are in the second part of this blog article.

If you would like to be notified of new publications on our blog, please leave your e-mail address below. You will get an automatic email every time a new article is posted. And don’t worry we won’t spam, we hate it just as much as you do 😉

2 Comments

I don’t agree with you, using debt can drastically increase your ROI. Have you never read Kiyosaki? If I had the funds you invested for your three properties in Rotterdam, I would have bought six properties with the least amount of money out of my pocket and I might have had a 15% return (30% with Airbnb) on the capital invested.

I hope your readers don’t follow this bad advice!

Hello Seb, thank you for your comment. Of course using debt can increase your ROI. However, with financial freedom, the ROI isn’t the only thing to take into account. We like lowering our risk and dependency of financial institutions as well and that’s why we work without debt if possible.