One of the most common and interesting ways to invest your money is to buy real estate. In part one of this blog article, we shared the first five big mistakes when investing in rental property. In this article, we complete the list with the other five of the ten big mistakes when investing in rental property.

How to invest in rental property?

In just five years, we were able to build a small but sufficient real estate portfolio. We currently rent out two properties to students. Each house has three separate rooms, which are occupied by a student. We were able to invest in these properties by creating a multiplying effect. Each time we invested in a property, it took us less time to save enough money to invest again.

If you would like to know how we did this, you can read the blog article about how we saved money to pay for our houses in cash.

From financial security to financial freedom

For us, investing in property started as a way to build financial security for the future. Since we are both entrepreneurs, we have to arrange a situation in which we can look after ourselves, since we do not have a pension plan from an employer.

Interestingly enough, after starting our journey of investing in rental property, we soon discovered that investing in the right kind of real estate is a very smart tactic to create financial freedom early in life.

“Investing in the right kind of real estate is a very smart tactic to create financial freedom”

Against our own expectations, we were able to create a financial situation in which we live for free AND are earn more than 2.000 Euros in tax-free rental income per month. Our actions to create a financially secure future in the long term were also helping us create a financially free life in the short term. If you want to learn more about how we can retire before we’re 40. You should definitely read this blog article.

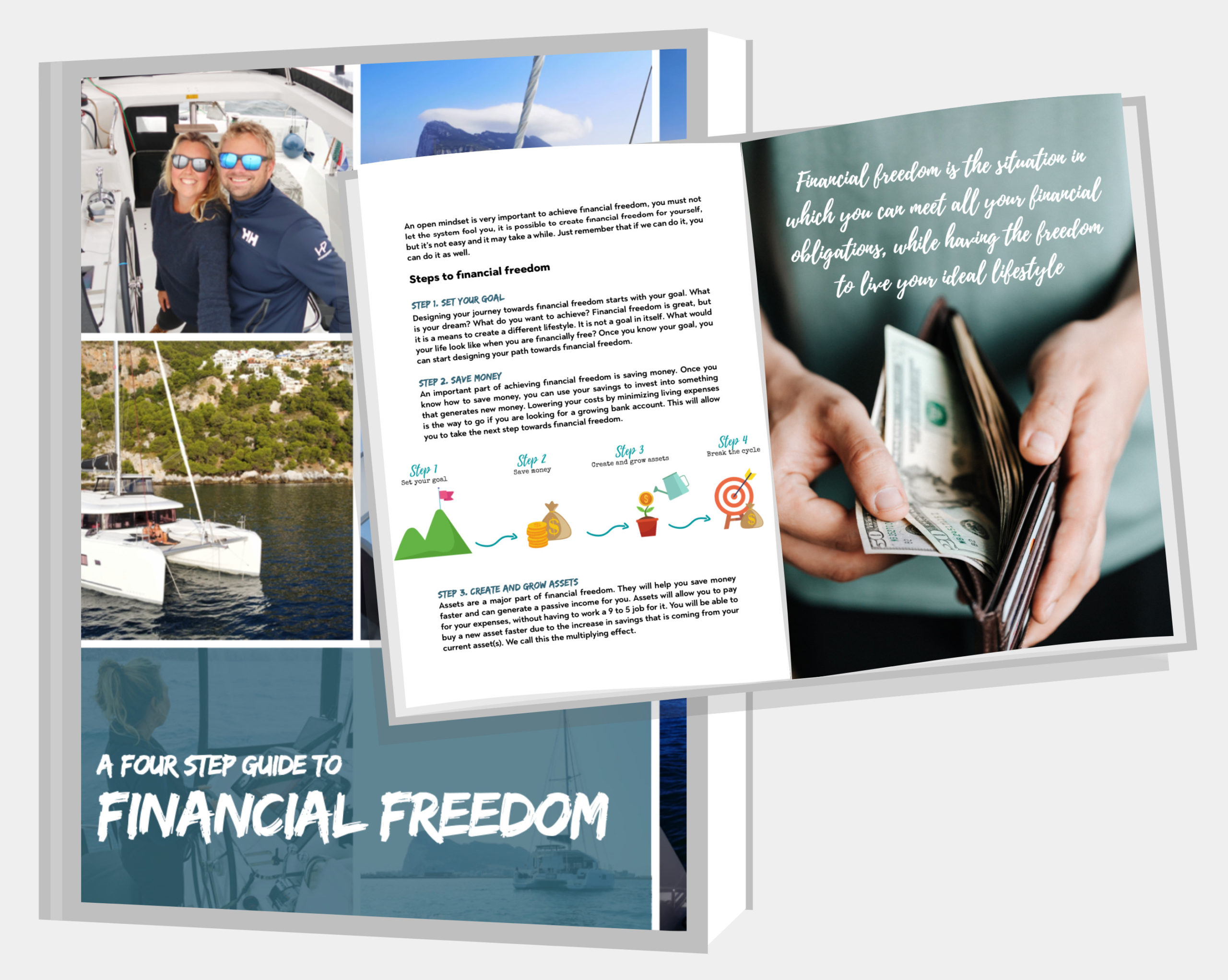

SUBSCRIBE & DOWNLOAD YOUR FREE GUIDE

We share our steps & tips about Financial Freedom in a cool and free PDF guide. Subscribe to our newsletter by leaving your email below and you can download the guide right away!

The first five BIG MISTAKES

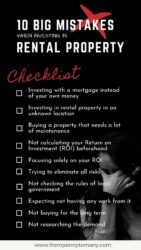

In part one of this blog article, we summed up five things we would definitively advise you NOT to do when starting to invest in a rental property. These mistakes were:

- Investing with a mortgage instead of your own money

- Investing in rental property in an unknown location

- Buying a property that needs a lot of maintenance

- Not calculating your Return on Investment (ROI) beforehand

- Focusing solely on your ROI

If you are curious to read more about these mistakes and to read their explanations, please go to the article here.

The five other BIG MISTAKES when investing in rental property

So let’s continue the list and give you the other five big mistakes when investing in rental property:

If you want to start with mistakes 1 to 5 (which we advise you to do), please go to the article via this link.

Otherwise, we will just dive into mistakes 6 through 10 below.

6. Trying to eliminate all risks while investing

Renting out a property comes with risks. There is no way of ignoring that. Investing your cash in a certain house in a certain area or city is risky. Giving people the key to your house is risky as well. Tenants may destroy your property, they may stop paying rent, the housing market may collapse, the property may burn off, etc, etc.

A big mistake is thinking that you can eliminate all the risks. Let’s be honest: you can’t! Investing and renting out a property means embracing the fact that there are risks involved. You can manage risks so the chance that certain things happen is smaller (screening tenants for instance) and create ways to decrease the impact of the risk (via insurance for instance). Eliminating all risks will probably mean that you kill all the possible advantages of renting out the property altogether.

“Investing means embracing the fact that there are risks involved”

7. Not checking the rules of local government

Local governments often have a lot of regulations in place when it comes to renting out your property. The rules are different for different countries and cities, but please make sure to check them at your location.

Rules may include fire safety, the rent you may ask, the number of people living in a house, the possibility for tenants to register at the address and the income tenants need to live in a certain neighborhood. It is best to check the rules and regulations beforehand so you will not be faced with unpleasant surprises.

8. Expecting not having any work from it

Renting out a property comes with work. It, therefore, isn’t a completely passive income. Even if you have a management company that arranges most of the things for you. You still will need to be in contact with them to approve repairs and maintenance. Also, as a property owner, you will always be the person of contact for the government and the municipality.

Income from rental properties is relatively passive, but not for the full 100%. We are investing around 1 full workday each month per property easily.

9. Not buying rental property for the long term

Investing in real estate should be done for the long term. The additional costs of buying a property (notary fees and taxes included) make it sort of useless to invest in a property for only a few years.

Investing for the short term is more focused on speculating on the housing market, for instance by flipping houses. This approach is a completely different ball game from investing in rental property. Investing in rental property is great for a longer period, since you may find reliable tenants over time that love the property and will provide you with a very steady and relatively stress-free passive rental income.

10. Not researching the demand

Next to not knowing the area in which you are investing with a rental property (mistake 2 from the first blog article) and not knowing the rules of the local government (mistake 7, see above) it is also a big mistake not to investigate the demand for rental properties before you invest.

If you are investing smart, you need to invest in a property that is in line with the demand. Investigating beforehand will help you determine the kind of property you should invest in. What kind of housing do renters look for? What are common rental prices? Are there students in the area? Do people look for long or short-term rentals? What will be a possible ROI for your investment?

It may be smart to test the rentability of the property before investing, for instance by putting up a ‘fake’ advertisement on a website. How many people react and are interested? How do they react to the rental price that you propose?

So there you have it! The complete list of mistakes investing in rental property

We made a visual image for you with all the mistakes. If you click the image to the right, you can download the checklist of the 10 big mistakes when investing in rental property.

We are very curious, which mistake is the most important one? And which mistakes you think are often made when investing in rental property? Please leave a comment in the section below.

Subscribe

We hope you like this article. If you would like to be notified of new publications on this blog, please leave your e-mail address below and you will receive a notification every time a new article is published.