This blog article is about financial freedom. It covers how to define financial freedom and how you can achieve it. It also gives you information about the approach I took to retire early to travel the world full-time. This blog article is part of the cornerstone content of From Penny to Many, so I will update it regularly and add links to relevant other blog articles for further reading.

Introduction

When people think about financial freedom, they probably think of someone in their late 60’s. A retired person has saved his/her whole life and has a huge pension fund. This way of retiring is the social norm and is used by plenty of people. A norm that we all know well, but it is certainly not the only way to achieve financial freedom.

In the ‘old’ definition, retirement means that you don’t work anymore at all. In the ‘new’ idea of retirement, retirement simply means that you don’t HAVE to work anymore, or that you choose to work less. This can be achieved at any age, as long as you have another income source to cover your expenses.

The Financial Independence Retire Early (or FIRE) movement is all about this idea, showing new concepts to fuel financial freedom. Concepts such as FIRE are rapidly growing, showing that many people are looking for new ways to create financial freedom.

What is financial freedom?

Financial freedom for one means something different than for the other. When I asked people on my Instagram account to give me a definition in their own words, I got so many variations.

A few of these definitions are in the image below:

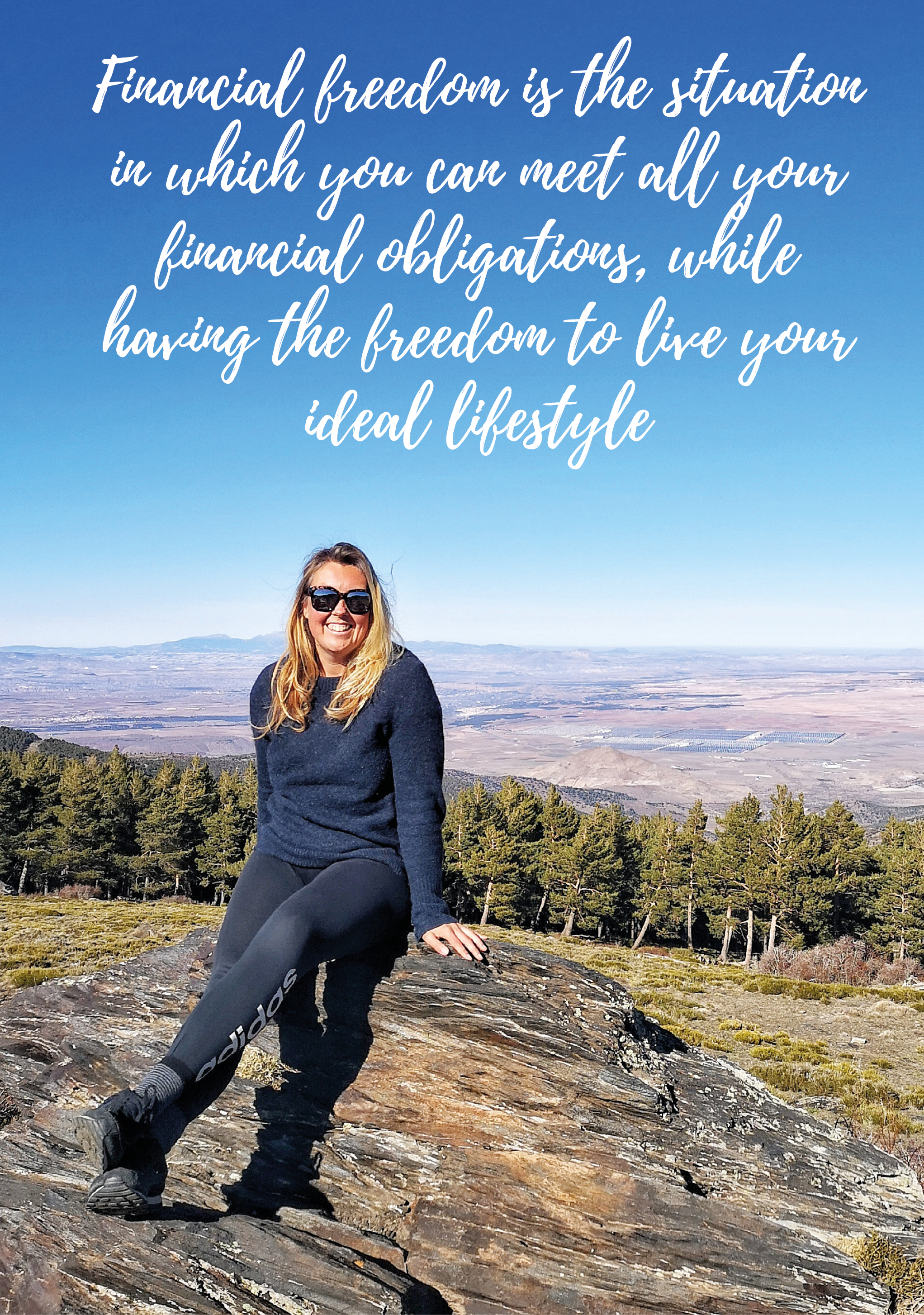

Although financial freedom is different for everyone, there is a general way of looking at it that works in each situation. On this blog, I define financial freedom as the situation in which you can meet all your financial obligations while having the freedom to live your ideal lifestyle.

If you break this down, we can see that financial freedom has to do with:

- Your financial obligations

- Your ideal lifestyle

These are two sides of the same coin and they balance each other out. If your ideal lifestyle is simple and nonmaterialistic, your financial obligations will probably be smaller. And thus, financial freedom will be easier to achieve.

If your ideal lifestyle involves a lot of shopping, eating out, and spending money on luxuries. Your financial obligations will be bigger and you will need more money to make it to total financial freedom.

If your ideal lifestyle involves a lot of shopping, eating out, and spending money on luxuries. Your financial obligations will be bigger and you will need more money to make it to total financial freedom.

Why is financial freedom important

The interesting thing is that in life, we’re mainly taught to focus on meeting our financial obligations. Our educational system is aimed at creating a set of skills to allow you to have a good career, earn a decent amount of money and pay for your bills.

School is not about discovering your ideal lifestyle. It’s a system based on prepping you for a future in which you are able to avoid unemployment. Of course, schools may promote themselves by claiming they are here to develop your talents. But if that was truly the case, our educational system would look very different.

The problem with our work-focused approach

The problem is that this work-focused approach to living your life has left a whole workforce drained of energy. A large sum of people is not delivering value from their talents. They exchange time for money to make ends meet. In our modern world, achieving an ideal lifestyle is seen as something luxurious, a thing you may be able to achieve after a lifelong career.

I feel that instead of prioritizing your financial obligations, you should start with a vision of your ideal lifestyle. And use that ideal lifestyle to work out your financial plan. A plan that supports that lifestyle. That is the approach that lets you create a financial situation that suits you. You make your own dreams in life the top priority and live your life in line with your own values instead of how our economic-driven society is designed.

Since you are reading this blog article, you probably already realized that life is about more than making money in a job you don’t like. Putting your ideal lifestyle first is why financial freedom is so important.

How do you get financial freedom?

Okay, so now you’re getting excited! You are ready to prioritize your ideal lifestyle and make it happen. But how does that get you to financial freedom?

Sticking to a 9-5 job and working hard for a decent income is the most common choice people make when it comes to financing their life. But, having one income stream from one job doesn’t provide much financial security and it actually might be a very risky approach in the current volatile world we live in. In addition, for most of us, our current job isn’t part of our ideal lifestyle, should we have the freedom to choose it.

Does this mean you should quit your job right away? Of course not! Designing financial freedom is all about adopting a different approach. This can be difficult because most people follow the 9-5 path and may think you are crazy. With this blog and the Financial Freedom Toolkit, I want to show you how a financial freedom mindset combined with some strong atomic habits is the ultimate cocktail to achieve financial freedom.

Different ways to get to financial freedom

There are different ways to achieve financial freedom. One very well-known and popular one is the FIRE movement. Financial Independence, Retire Early (FIRE) is a movement of people devoted to a program of extreme savings and investment that aims to allow them to retire far earlier than traditional retirement plans would permit.

The FIRE movement was inspired by the 1992 book Your Money or Your Life. By saving up to 70% of their annual income, FIRE retirement proponents aim to retire early and live off small withdrawals from their accumulated funds.

I myself used a different approach to achieve financial freedom. It’s is an approach based on investing your savings into assets that generate a passive income. Instead of accumulating a big amount of savings and living from that. This approach allows you to speed up the process because you need to save less money. It does however require you to investigate the opportunities of possible investments that generate a steady monthly income.

In any case, the most important thing when working on financial freedom is to not let the system fool you. it is possible to create financial freedom for yourself. It is not easy and it may take a while, but just remember that if I can do it, you can do it as well!

GET THE FINANCIAL FREEDOM TOOLKIT

I created this amazing online toolkit about financial freedom. I share it using the Pay-What-You-Want-approach. This means you can pay any amount you feel is appropriate after using the tools. Check out the Financial Freedom Toolkit here.

What are the steps to financial freedom?

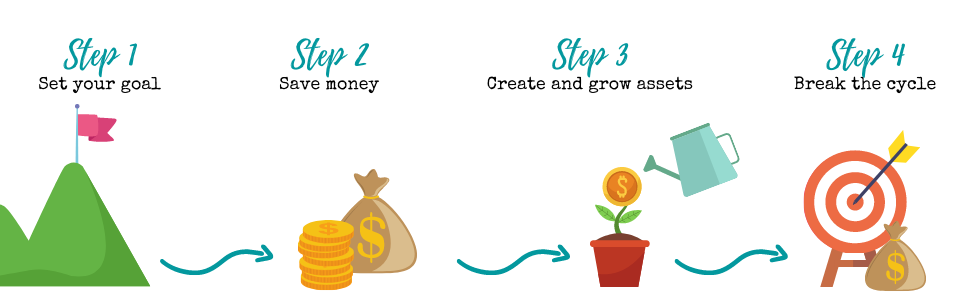

I hope you now have a clearer image of what financial freedom is, why it is important and how you can get to financial freedom. So, to end this blog article, let me take you through the four steps I took to become financially free before my 40th birthday:

Step 1. Set your goal

Designing your journey towards financial freedom starts with your goal. What is your dream? How would you describe your ideal lifestyle? And what do you want to achieve? Financial freedom is great, but it is a means to create a different lifestyle. It is not a goal in itself. What would your life look like when you are financially free? Once you know your goal, you can design your path towards financial freedom. I call this goal, your Big Hairy Audacious Goal.

Step 2. Save money

An important part of achieving financial freedom is saving money. Once you know how to save money, you can use your savings to invest in something that generates new money. That is how I was able to buy a house completely in cash. Lowering your costs by minimizing living expenses is the way to go if you are looking for a growing bank account. This will allow you to take the next step towards financial freedom.

Step 3. Create and grow assets

Assets are a major part of financial freedom. They will help you save money and can generate a passive income for you. Created assets reduce your financial risk. They will allow you to pay for your living expenses, without having to work a 9 to 5 job for it. Due to the income from your asset(s), you will be able to grow towards investing in new assets faster. We call this the multiplying effect and it’s way more efficient than the traditional compound interest method.

Step 4. Break the cycle

The beauty of the financial freedom process lies in the last step: when you decide to break the circle. You have created a way in which you are able to live from the income from your assets without having to work a full-time job to pay for your expenses anymore. It is time to live the life you want without having to worry about income. Welcome to Financial Freedom!

Blog article summary

To conclude and repeat, let me give you a summary of the main points of this article:

- Financial freedom means something different for one than for the other. It ranges from being completely self-sufficient to having the option to partly quit your job whenever you fancy

- On this blog, I define financial freedom as the situation in which you can meet all your financial obligations, while having the freedom to live your ideal lifestyle

- Financial freedom has to do with prioritizing your ideal lifestyle, instead of your financial obligations

- We’re mainly taught to focus on meeting our financial obligations: have a good career, earn a decent amount of money and pay for your bills. But this haft left a whole group of people feeling stuck in the system

- There are multiple ways to achieve financial freedom. The FIRE movement is a very well-known approach, focusing on saving a large sum of money to live from

- The approach I used to achieve financial freedom is based on investing your savings into investments that generate a passive income. That way, you need to save up a smaller amount to become financially free

- Getting to financial freedom requires going through 4 steps: 1. Set your goal, 2. Save money, 3. Create and grow assets and 4. Break the cycle.